DOJ Appeals Google Search Remedies and What It Means for Law Firm Marketing

Posted on Tuesday, February 17th, 2026 at 11:59 pm

The Fight Over Google’s Power Is Far From Over

The U.S. Department of Justice and a coalition of state attorneys general have appealed the federal court’s remedies ruling in the Google search monopoly case. While Judge Amit Mehta previously found that Google unlawfully maintained its dominance, the government argues the corrective measures did not go far enough to restore real competition.

At the center of the appeal are Google’s default search agreements and the court’s refusal to require a sale of Chrome or ban payments for default placement. For law firms, this next phase carries real weight. Control over where search appears determines who captures traffic, and traffic drives both SEO visibility and paid advertising costs. The structure of online search is once again in play.

Why Default Search Deals Remain the Core Issue

At the center of the appeal are the multibillion dollar agreements that secure Google’s position as the default search engine on smartphones and browsers. Trial evidence showed Google pays enormous sums to companies like Apple and major Android manufacturers to maintain that placement. While users can manually change their search provider, most never do.

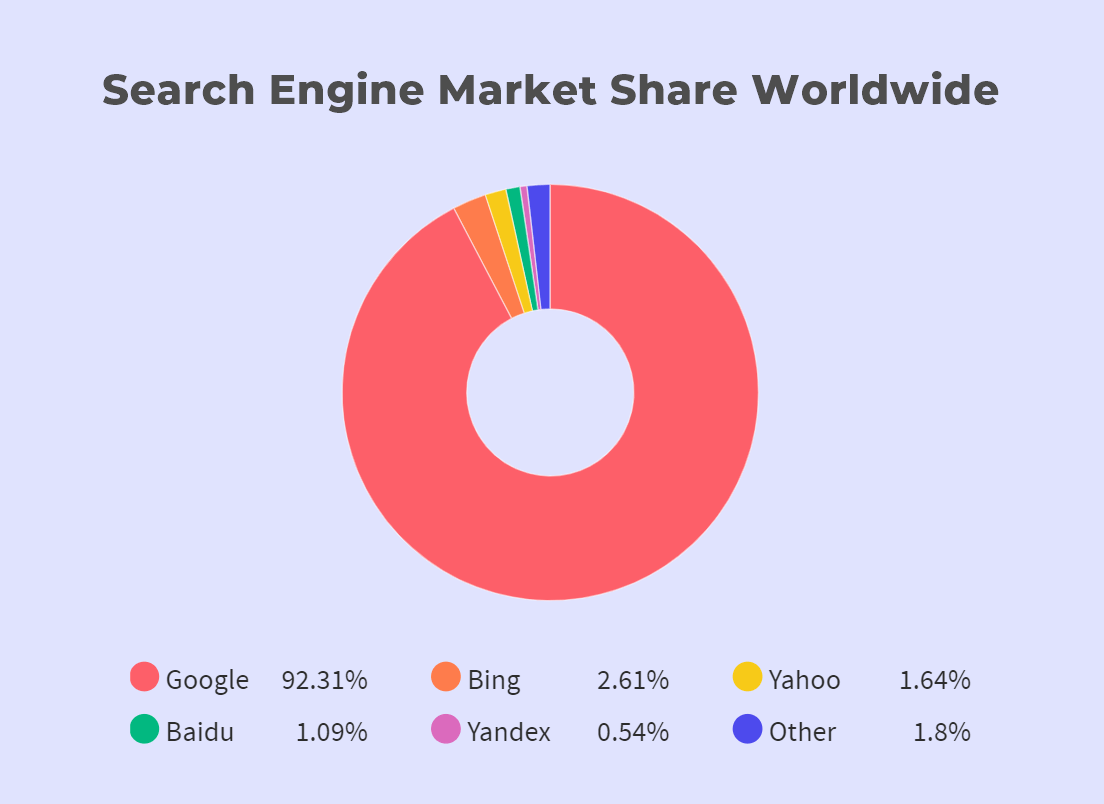

Default status drives query volume at scale. More queries mean more ad impressions, more bidding competition, and more data flowing back into Google’s systems. Prosecutors argue that allowing these payments to continue, even with annual rebidding, leaves the primary distribution channel largely intact. For law firms competing for high value legal keywords, who controls default access directly influences traffic flow and advertising costs.

Source: ABC News

Chrome’s Role in Controlling Access to Search Traffic

Chrome remains a focal point because it serves as a primary gateway to online search. A substantial share of Google search queries begin inside the Chrome browser, giving Google influence over how search is presented and integrated with its advertising systems.

Regulators are focused on who controls the gateway where users begin their searches. The trial court declined to require a divestiture of Chrome, but that issue is expected to resurface on appeal. If the appellate court revisits structural remedies, Chrome could again become central to how search competition is rebuilt.

What Law Firms Should Watch During the Appeal

The appeal now moves to the U.S. Court of Appeals for the D.C. Circuit, where judges will decide whether the current remedies are sufficient or whether stronger measures are required. That process will take time. During that window, Google’s existing contracts remain in place, subject to annual rebidding requirements.

Law firms should pay attention to two variables: distribution and auction pressure. If default search agreements face tighter limits, competing engines could gain traction, affecting where prospective clients begin their searches. At the same time, any disruption to Google’s control over placement could influence query volume and cost per click for competitive legal terms. Both outcomes would directly affect budget planning and visibility strategy.

How This Could Affect Law Firm SEO and PPC Strategy

If the appeal leads to stricter limits on default search deals, traffic patterns could change. More users may encounter alternative search engines during device setup. That means firms cannot assume that every high-intent search begins on Google.

On the paid side, search volume and advertiser density drive cost per click. If Google’s distribution control weakens, auction pressure could adjust in either direction. Firms that measure cost per signed case, not just cost per lead, will be in a stronger position to control spend and protect margins while the courts sort this out.

Positioning Your Firm Before the Rules Change

Waiting for a final ruling is not a strategy. Firms should evaluate how dependent they are on a single traffic source and identify gaps in tracking, attribution, and conversion performance. Clean intake data, disciplined campaign management, and clear cost per case metrics create stability even when platform rules are uncertain.

Diversifying visibility does not mean scattering budget. It means building authority in organic search, maintaining disciplined paid campaigns, strengthening local presence, and owning first party data through email and remarketing. Firms that control their marketing infrastructure will remain competitive whether Google retains its current position or faces tighter court ordered restrictions.

Where TSEG Stands

The appeal will take months, or even longer before it can negotiate remedies. Either way, firms that understand where their current marketing strategy is heading, are diversifying into a multi-platform approach, and continuously optimizing on a signed-case level will remain competitive. Search access can change – but strong marketing fundamentals do not.

TSEG helps law firms build data driven SEO and paid strategies that produce high value cases in any environment. We focus on real case value, disciplined ad management, and long term visibility. If the rules adjust, our clients are ready. If they stay the same, our clients continue to grow.

If you want a clear view of how your firm is positioned, schedule a call with TSEG.